Airbus is racing ahead of competitor Boeing in commercial aviation. However, both are bleeding money in space. The European aerospace manufacturer’s space program misjudgements have required it to make around USD1 billion in charges in the first six months of 2024, Meanwhile Boeing’s flawed and costly Starliner spacecraft remains unable to return to Earth.

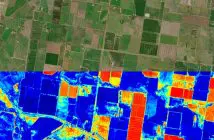

Airbus has a longstanding involvement in space, building Earth observation, telecommunications, navigation satellites, on-ground infrastructure, and space equipment such as power banks, avionics, and solar arrays.

Earlier this month, Airbus announced the French Space Agency had selected it to design and build two new generation microwave radiometers as part of the French contribution to the Atmosphere Observing System. In July. Airbus shipped its Sentinel-2C satellite, the third Copernicus Sentinel-2 satellite, to the European spaceport in French Guiana. But despite the pace of events, the space program is a drain on Airbus’s coffers, and CEO Guillaume Faury recently said that it needed a wholesale review.

“We’ve not been properly balancing risks and rewards in the contracts we signed between 2018 and 2021,” Faury told a recent second-quarter investors call. “This included, for example, contracting major development programs with significant technological gaps to bridge without the proper contractual conditions and the right organisation set up in front of it.”

He says the cost blowouts involve several programs, some of which can be fixed relatively quickly, but one almost decade long satellite program will take far more time to sort out. Faury said Airbus would better understand the charges they need to make against their balance sheet by the end of the year. While declining to identify individual projects, he did say the charges primarily concerned communication and navigation satellite programs rather than Earth observation programs.

Airbus’s communication and navigation satellite portfolio includes Eurostar Neo, OneSat, the OneWeb satellite constellation, and military communication satellites. Earlier this year, Airbus disclosed that OneSat, a new line of geostationary orbit communications satellites with a software-defined payload, had cost it EUR600 million in charges last year. Airbus was due to deploy the first OneSat satellites last year. However, none have yet launched.

“We have launched a turnaround for the programs,” said Faury. “It’s an important activity for me and the team to focus on the recovery of space – against a backdrop of a challenging space business environment. We are evaluating all strategic options given the nature of the situation.”

Meanwhile, things are not exactly sunny at rival Boeing, whose highly regarded space program has taken a financial and reputational hit by the faltering Starliner program. The first Starliner spacecraft to take astronauts to the International Space Station remains stuck there with technical issues. NASA lost USD288 million on Starliner last year and USD1.6 billion since kickstarting the program in 2016. What is meant to be a competitor to SpaceX may provide a major boost for that company if one of its spacecraft is required to rescue the stranded astronauts. Despite spending an unscheduled 50 extra days and counting on the ISS, NASA says its two astronauts are not stranded there.