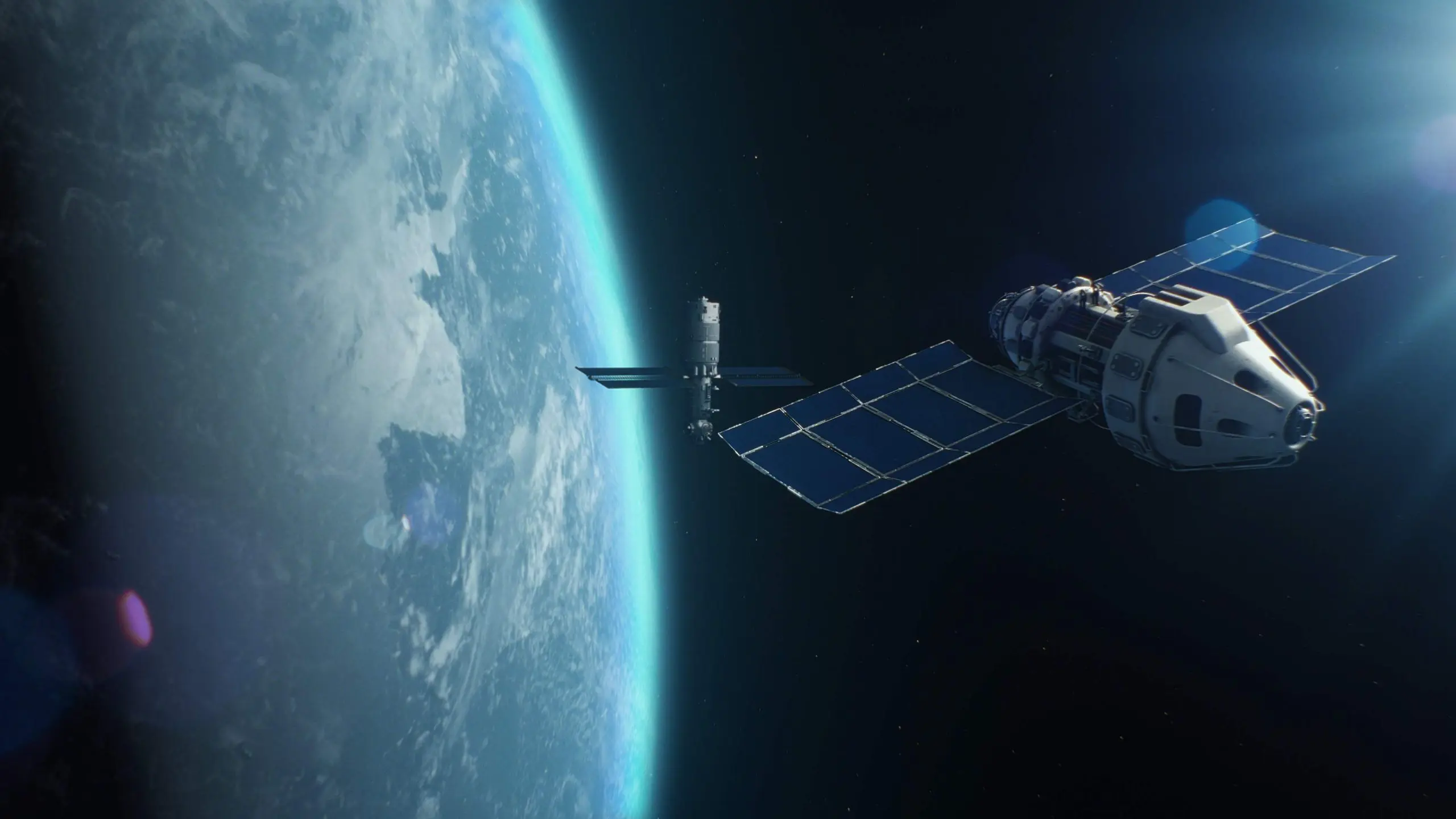

Two Australian space companies have been named among eleven global space startups to watch. Global Corporate Venturing, a website serving venture capitalists, has flagged Sydney-based Quasar Satellite Technologies and Gold Coast-based Gilmour Space Technologies as among the hottest small space companies on the planet that promise to capitalise on the falling cost of space launches.

Global Corporate Venturing likes Quasar because they are developing useful technology that would allow ground stations to communicate with hundreds of satellites at once, rather than the current one satellite at a time. “As the number of satellites in space proliferates and we use them for everything from aiding farmers to navigation, it is increasingly important to make communications more efficient,” the website says.

The venture capitalists are also keeping faith with Gilmour, which has yet to secure the necessary final approvals to conduct the maiden launch of its proprietary Eris rocket from its greenfields Bowen Space Port in Queensland.

“It (Gilmour) has raised USD107m to date, including a series C funding round in 2021, and employs more than 200 people,” Global Corporate Venturing says. Despite the space launch market becoming increasingly crowded, the falling cost of space launches makes launch companies like Gilmour a focus point for investor interest.

Quasar says its satellite technology will allow government and non-government entities to “hear the whole sky” and access a real-time map of every space object. It is squarely targeting defence and intelligence agencies and is making a concerted push into the United States. Earlier this year, Quasar participated in the US Air Force’s Catalyst Accelerator program.

Gilmour has been awaiting its final launch licence from the Australian Space Agency for most of the year. In May, the CEO said he was hopeful he might get conditional approval within weeks after supplying additional documentation to the space agency. Once granted, Gilmour must wait a mandatory 30 days while the Australian Space Agency informs governments about the impending launch.

Despite the delays, Gilmour’s promise of delivering cost-effective sovereign launch capabilities has attracted plenty of investor interest. Its backers include Main Sequence Ventures, Blackbird, Fine Structure Ventures, 500 Global, Hesta, HostPlus, NGS Super, and Ridgeline Ventures. Quasar has received financial backing from the CSIRO innovation fund, Main Sequence Ventures, Vocus, Saber Astronautics, Fleet Space Technologies and Clearbox Systems. It secured funding of AUD12 million in May 2021 and backed that up two years later with an AUD5.3 million contract with the Defence Innovation Hub and AUD6 million secured via a pre-Series A raise.

The space sector continues to attract strong venture capital interest. According to data from Space Capital, venture capitalists have invested USD286 billion in the industry over the past decade. As space becomes increasingly accessible and important, they are looking for startups with compelling products that have the potential to deliver massive returns on investments.

Other companies to make Global Corporate Venturing’s list include India’s Manastu Space, the US’s Impulse Space, Vestigo Aerospace, Orbit Fab, Amplified Space, Italy’s Picosats, and Germany’s OKAPI:Orbits, Orora Tech, and Morpheus Space.